Implementing a CSR approach - Standards and Frameworks: how to choose the right one?

Identifying relevant standards and frameworks is essential to enhance and make credible your CSR approach. The multitude of frameworks available today reflects the richness of accessible instruments to support companies at every level of the implementation of their strategy. This diversity also highlights the complexity of the challenges that companies face depending on their activities and specific characteristics.

What is a framework? What is a standard?

To properly guide your approach, it is important to identify the differences between a standard and a framework because they will not be deployed in the same way.

Frameworks and standards are part of “soft laws”, and their application is voluntary, unlike regulations that are referred to as “hard laws.”

A framework compiles recommendations or guidelines developed and adopted by a regulatory authority. It is a methodological tool for implementing an approach.

A standard is an established framework agreed upon by the parties directly concerned with the subject or field being addressed, which is validated by a regulatory authority. In addition to guidelines, it includes rules of application.

Choosing Standards and Frameworks that Suit Your CSR Strategy

To establish a coherent approach, it is important to take into account that frameworks and standards address different issues or objectives.

The company must choose the framework or standard that suits it, depending on what it wants to highlight.

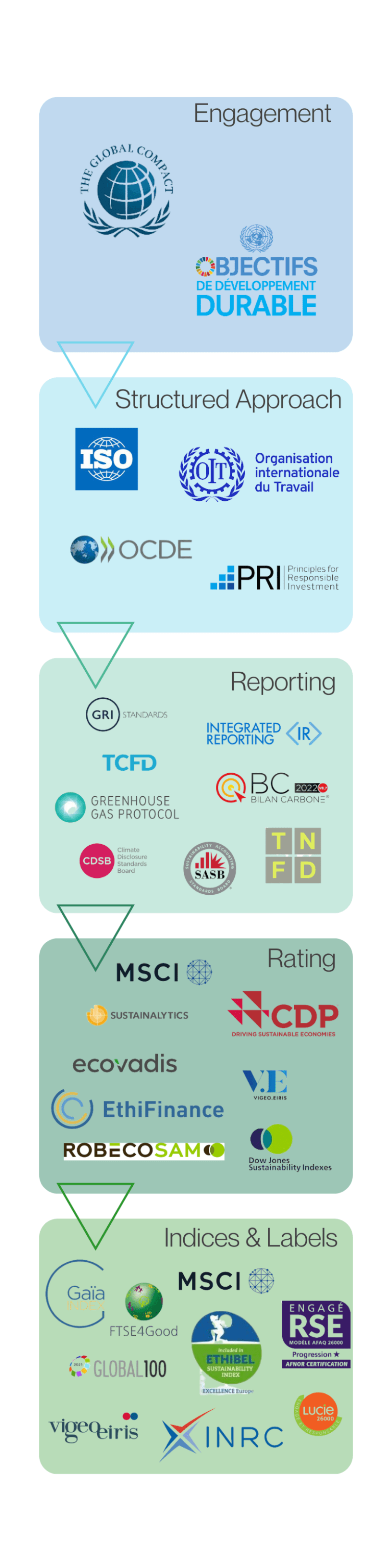

Reporting frameworks can be classified according to 5 different objectives:

- Commit to sustainable development.

- Implement a CSR approach.

- Report results based on predetermined ESG objectives.

- Have its non-financial performance evaluated by rating agencies.

- Obtain a ranking or label to enhance its CSR approach and compare itself to its peers.

A company can demonstrate its commitment to sustainable development by joining international frameworks such as the Global Compact and the United Nations’ Sustainable Development Goals.

To structure their corporate social responsibility approach, a company can rely on standards and references such as ISO 26000, OECD principles, PRI (Principles for Responsible Investment), and ILO standards.

Reporting standards, integrated reporting, or TCFD, provide companies with methodologies to organize their reporting and define relevant key performance indicators related to their material issues, enabling them to measure their non-financial performance.

Participating in evaluations offered by non-financial rating agencies and analysts, ESG investment funds, etc., allows companies to be appreciated for their efforts in determining their RSE strategy, implementation, and performance. These evaluations offer participants improvement avenues for each issue, which are real assets for evolving their practices. Some of these initiatives include CDP (Carbon Disclosure Project), Ecovadis, MSCI, ROBECOSAM, EthiFinance, Sustainalytics, and V.E (Vigeo Eiris).

Beyond ratings, labels and stock market indices mark the recognition of companies’ CSR commitment, identifying them as “best performers” among their peers. The must-have stock market indices include DJSI (Dow Jones Sustainability Index), FTSE4Good Index Series, Euronext V.E, MSCI, Gaïa Index, Global 100, Ethibel Sustainability Index, and CAC 40 ESG. As for sustainable development labels, there is the Lucie label, the AFNOR “label RSE Engagé”, and others.

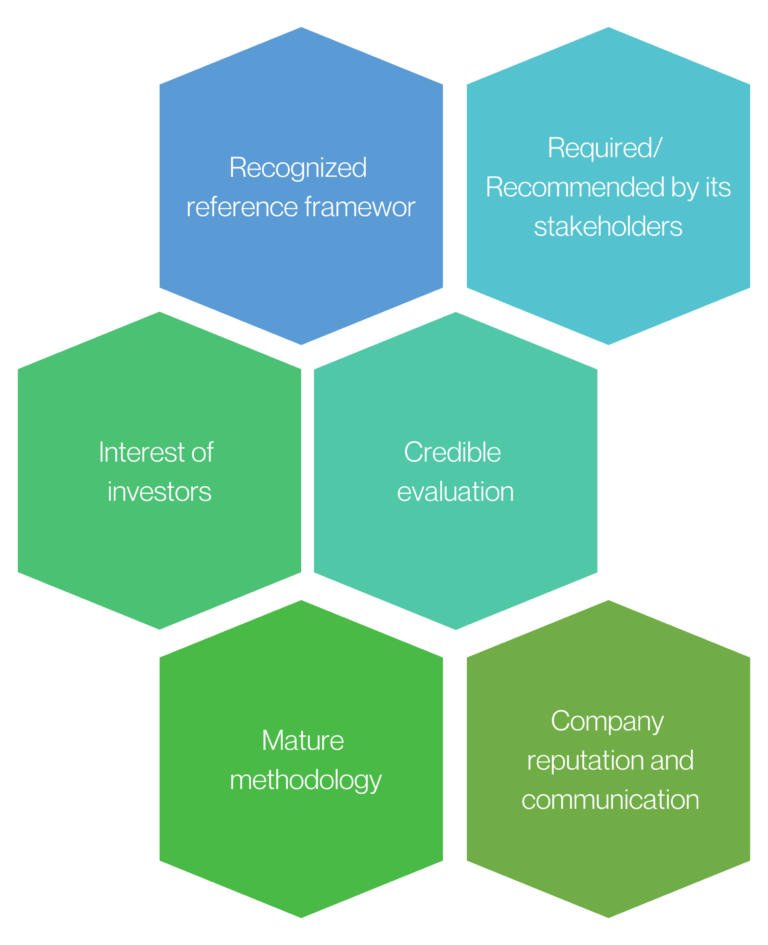

What characteristics should be taken into account when choosing a framework or standard of reference?

Sector-specific standards and references

Using sector-specific standards will help the company easily identify material issues that correspond to its industry.

Among sector-specific standards are SASB with an adaptation for 77 industries, which offers reporting standards specific to activities with the strongest economic, environmental, and societal impacts.

These standards facilitate both the understanding of published information and results, and comparability between companies in the same sector for ESG readers and analysts.

Standards that address all stakeholders of the company

The company must ensure that the choice of reference frameworks includes the expectations of all its stakeholders.

It is essential to identify among all these frameworks which ones are required or recommended by its main stakeholders (investors, customers or clients, banks, etc.) in order to remain attractive and maintain sustainable relationships with them.

A single standard or guideline may not necessarily cover all their requirements. Sometimes, a first approach may need to be complemented by a second or third approach.

Frameworks relevant in terms of material challenges

They help to value and give credibility to a process as they rely on a mature methodology, a robust evaluation system, and a strong reputation among third parties.

Robust standards, widely recognized by peers

The organization must also take into account the frameworks that allow for relevant and concise communication of information about its material challenges.

Thematic frameworks

Some of the frameworks mentioned above specialize in specific areas such as climate and carbon emissions (CDSB, TCFD, CDP, GHG Protocol, Carbon Footprint method, etc.), impacts on water, air or forests (CDP), biodiversity (TNFD), responsible purchasing (Ecovadis), or customer relations (INRC). Depending on their activities and priorities, organizations can use these initiatives to delve deeper into these areas.

An ever-evolving field: the importance of monitoring.

Monitoring the evolution of standards is essential: frameworks evolve regularly and new methodological guides are published to enable the entities that use them to improve their understanding and application.

In the face of a multitude of existing approaches, the trend is also towards harmonization and standardization of practices. Numerous frameworks such as SASB and IIRC, or CDP and CDSB, are coming together to coordinate their efforts to offer economic actors complementary tools to help them improve their approach. It is therefore important for any CSR department to be attentive to any updates that could help refine its approach.

To go further :

CDP and CDSB team up to provide the building blocks for successful TCFD disclosure : https://www.cdsb.net/task-force/1039/cdp-and-cdsb-team-provide-building-blocks-successful-tcfd-disclosure

IIRC and SASB form the Value Reporting Foundation, providing comprehensive suite of tools to assess, manage and communicate value :

https://www.sasb.org/wp-content/uploads/2021/06/Value-Reporting-Foundation-Press-Release-Final.pdf