Warning: Undefined array key "template_id" in /home/clients/ce20f0df565ed4eff4e3789a2c9be3f5/sites/kshuttle.io/wp-content/plugins/sitepress-multilingual-cms/addons/wpml-page-builders/classes/Integrations/Elementor/class-wpml-elementor-translate-ids.php on line 157

Omnibus Directive: what the new proposal means for European Taxonomy

Introduction

On February 26, 2025, the European Commission presented its Omnibus Directive aimed at “simplifying” the administrative burden imposed on companies by several pieces of legislation, including the CSRD (Corporate Sustainability Reporting Directive) and the Taxonomy Regulation. Following on from our previous article on the changes planned for the CSRD, today we’d like to focus on the changes affecting the European Taxonomy.

This article will help you understand :

- The objectives of this reform.

- The main changes to the scope and content of the Taxonomy report.

- Measures to reduce the administrative burden, particularly for SMEs.

- Upcoming events to remember.

1. What is the European Taxonomy?

Coming into force in July 2020, the Taxonomy Regulation is at the heart of the European Union’s climate and environmental strategy. It defines the criteria for identifying economic activities considered sustainable, thus encouraging the redirection of financial flows towards projects with a strong positive environmental and social impact.

With the proposed Omnibus Directive, the European Commission now wishes to adapt the Taxonomy to a changing geopolitical and economic context (war in Ukraine, rising energy prices, international tensions, etc.), while preserving the initial objectives of transparency and environmental compliance.

2. Main changes for Taxonomy in the Omnibus Directive

2.1. Reduced scope of application

New thresholds: only companies with over 1,000 employees and net sales in excess of €450 million would be required to publish a Taxonomy report.

Companies below these thresholds would therefore be excluded from the obligation, but would have the option of voluntarily declaring their activities aligned or partially aligned.

💡 Please note: the scope of the Taxonomy remains correlated to that of the CSRD. So, if you are no longer subject to the CSRD, you are also no longer subject to the Taxonomy reporting obligation.

2.2 Creating an opt-in category

Companies with more than 1,000 employees and sales of less than €450 million may, if they wish, publish a report describing the alignment (total or partial) of their activities with the Taxonomy.

In this case, they must disclose their ratios for sales and capital expenditure, while disclosure of operating expenses remains optional.

2.3 Reducing the “runoff” effect on SMEs

To prevent SMES are indirectly forced to prove their alignment, loans granted to them by credit institutions are excluded from the Taxonomy reporting obligations of financial entities.

This provision should limit the pressure on small structures, which, because of the value chain effect, were sometimes forced to communicate complex information.

2.4. 2-year postponement for CSRD waves 2 and 3

In the same spirit of simplification, the Omnibus Directive provides for a two-year postponement of Taxonomy compliance for large unlisted companies (wave 2) and listed SMEs (wave 3).

🎯The aim is to prevent them from publishing a report by 2025 or 2026, and then possibly being excluded from the obligations.

2.5. Simplifying the contents of the Taxonomy report

Companies will only have to assess eligibility and alignment with regard to significant financial activities. The absence of materiality will be presumed if the cumulative value of the activities is less than 10%.

For activities below this threshold, a separate, aggregated statement will suffice, reducing the complexity of reporting.

2.6. Possibility of “partial alignment

Companies can declare that an activity meets part of the Taxonomy criteria, without being fully compliant.

In this way, they remain transparent about their transition process, while officially recognizing the progress they have already made.

2.7. Revised requirements for substances of concern (Appendix C)

The European Commission is considering simplifying or repealing the provisions relating to certain substances in Annex C of the “Climate” and “Environment” delegated acts.

This measure is designed to make reporting easier for companies, who are often faced with technical difficulties in filling in this data.

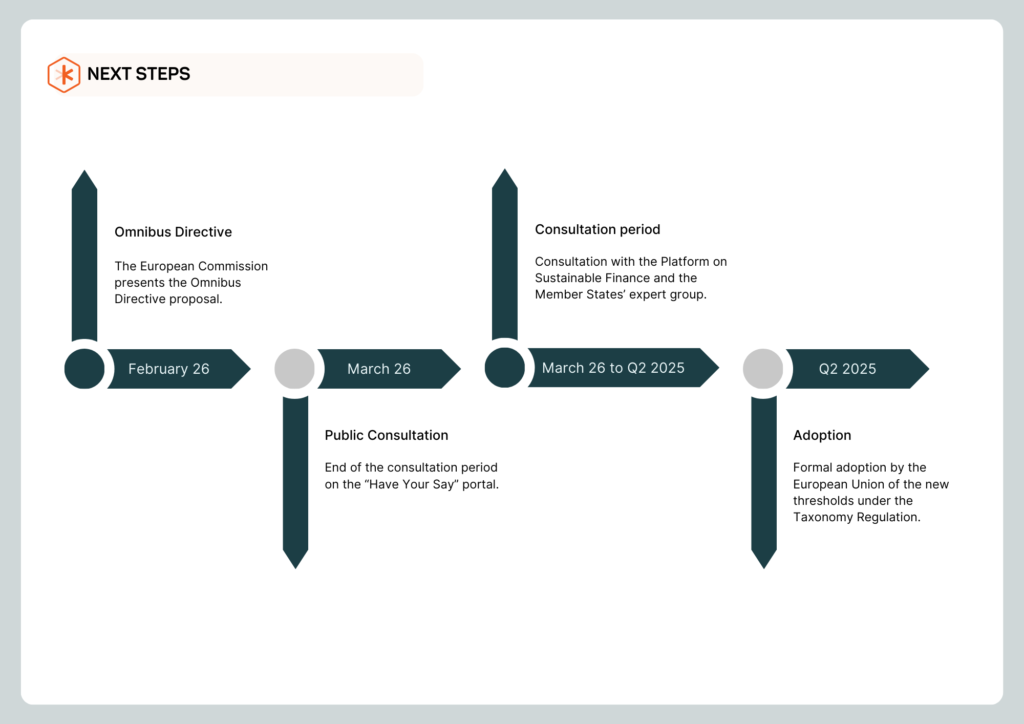

3. Timetable and next steps

Conclusion

The Omnibus Directive aims to make the European Taxonomy more flexible and less costly to implement, without sacrificing the original objectives of transparency and environmental consistency. The main changes concern the reduction of the scope of application, the possibility ofopt-in for companies not covered, the simplification of reporting content and the creation of partial alignment.

For companies, these adjustments are both an operational relief and an invitation to promote their sustainable development efforts, even if they do not yet meet all the criteria. The legislative process and final adoption of these measures remain to be closely monitored.

See the content of the proposed Directive :

> Proposal for a Directive of the EU Parliament and the Council amending CSRD and CS3D (2025.02.26)